When earthquake/tsunami struck Japan on Friday, I'm sure you would have heard in the media how this was affecting the sentiments of the markets. Here are few things one must know :

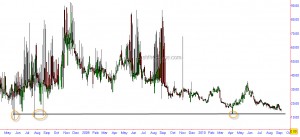

Let us take a look at the powerful Kobe Earthquake that struck Japan in 1995 and caused $102.5 billion damage:

It is obvious from the chart that the Earthquake occurred during the down trend and did not create any reversal on its own.

Now let us a look at the Latur Earthquake that left nearly 8000 dead in India and its impact on Sensex.

What about the Tsunami of 2004 that left 230,000 dead in Asia?

Looking at the charts, if one were to think no natural disaster occurred on Dec 26th 2004, he/she can be excused!!

The picture is similar even if one looked at the man-made disasters like Bomb blasts and terrorist attacks!

The infamous WTC attack:

While the reaction may have been pronounced, would it have mattered had it occured when the market trend was up?

So let us look at markets reaction to mumbai serial blasts of August 2005:

So, the next time you hear someone on media say that such and such exogenous events is causing the markets to decline you might want give these charts a thought. While there might be initial knee jerk reactions, these events do not even cause short term reversals!!! All one has to know is, what is the trend.