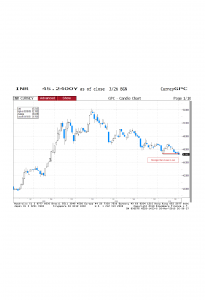

Rupee closes at the best level since 2008

The Indian currency is stronger that it was in January and had finished last week at its best level since September 2008. The tide is strong and is a precursor to clearing the highs of 5300 on the Nifty.

For those who have bloomberg access here is the link to my note of October 09 { NSN KR6WCM07SXKX <GO>} - I had anticipated the Indian rupee to strengthen 12%.

US Ten year note’s yield set for 4.1%

Trade Idea – 2 Stocks set to make new 52 week highs

One more reason to be bullish

The Dow Theory "buy signal" that was in effect from last July, got another reconfirmation today with the Dow Industrials closing above its January high of 10725. With this, all the three Major US Indices(Dow, S&P and Nasdaq) are clocking higher highs and higher lows thereby implying that the primary up trend that began in March 2009 remains in good health.

While markets might pull-back in the near term, today's move has further increased the odds of Dow Jones Industrial Average scaling 11200. ( I have been holding this view since last July - see my Bloomberg report dated July 24th)

Nifty still down YTD

Though Nifty is on its sixth week of back-to-back gains, the benchmark is still marginally down on YTD basis if measured in local currency. The benchmark is up 2.35% if we take the base currency as USD or 4.35% if we take the base currency as Swiss Franc.

Interestingly, China is the worst performing index and Colombo's All Share Index is the best performing index in the Asian region.

Transports at 52 week high

Dollar Index at an interesting juncture

Dollar Index's (DXY) December-February rally had once again raised the spectre of deflation and had pinned down the equity markets. The recent rally off the Feb lows in equity markets is interesting, given the fact that the DXY has had a strong inverse correlation with equities since the Lehman collapse and it has hardly retraced off its highs. I had a closer look at the long term technicals and there were a few very interesting data points.

1) If we step back and have a look at the weekly charts over a ten year period the DXY is in an enormous structural bear market. Even a four year old would tell you that the trend is down (Yes, my son did say so).

2) Though the recent rally from 74 to 81 looks like a trend-shift, my preferred weekly wave count, seems to suggest that this could be just a corrective move (wave 4) and a weekly close below 79.7-79.65 could mark the start of next leg in the down trend.

3) The three-legged rise from 74 & change has not even been able to touch the 50% retracement point of the 2008-2009 decline. This is hardly a sign of strength.

4) On March 2nd, the Index failed to clear its Feb highs. A failure at resistance on the first anniversary of topping out often generates a powerful sell signal.

So the recent market action seems to suggest that either the Dollar Index is set for another leg of decline and hence there would be more money chasing all asset classes. Or the inverse correlation that existed between the Index and the Equity markets is coming to an end. Either way, it seems like a win-win situation for the bulls.

- Dow transports nears 52 week high

While the Dow Industrials and S&P 500 are yet to take out their 52 week high's the small cap Russell 2000 has scaled above its 52 week high and is holding well above it. This shows that the risk appetite of investors is still alive and kicking. In yesterday's session, the Nasdaq composite too notched a close above its January peak.

Another Index Dow transports, often considered a very good measure of the US economy, is just short of its 52 week high. A new high here will be a shot in the arm for the Bulls.

Nifty on a new channel

After 4 successive weeks of gains, the 5th week has also started off on a winning note for the Nifty. Excepting 2008, whenever the broad markets have clocked 4 successive weeks of gains, my visual analysis of Nifty and Sensex tells me that markets are embarking on a powerful rally.

At the very least one can expect Nifty to scale the upper borders of the channel shown above in the charts, currently in the region of 5600.