A couple of weeks back I had posted a note on my own derived indicator and highlighted how important it was for the indicator to hold above the previous trough. On Friday, this indicator dipped below the previous trough on a closing basis and has warned that the Indian markets have probably peaked and a bearish phase is a very distinct possibility. So naturally one has to ask - how has this indicator fared in the past?

Indian economy barometer

This indicator has a commendable track record over the last 10-12 years:

1) In 1999 - the indicator peaked in Oct 1999, and warned of a bear market a few weeks before Sensex and Nifty peaked.

2) Likewise in 2003 when the Sensex/Nifty bottomed in April, this indicator was a few months ahead signalling an impending new bull market (some might consider Oct 01 as the bottom for the Indices, even then this indicator was ahead)

3) In 2006, during the infamous sharp drop in May this indicator stood its ground.

4) In Oct/Nov 2007, this indicator warned of an oncoming bear market. The Indian markets peaked in Jan 2008.

It is often a good idea to look at other inter-related markets before coming to a conclusion about a major trend-shift. And here is where the fixed income /bonds come into the picture. Here is a chart of the 10 year OIS swaps.

10 Year Swaps - Daily Charts

As is evident from the chart, there is still an intense struggle to cross the 200 DMA. AND when stock markets were trading near the all time high, the 10yr swaps were actually miles away from the peak made in February! If stocks are that attractive why are investors still seeking the safety of fixed income?

I have for quite some time held that the continuation of this bull market is largely dependant on the debasement of the USD. Which was exactly why I had stressed the importance of staying near the door of the bullish camp and having price objectives as opposed to a price target (see CNBC interview) on emerging markets, Gold, Silver and other asset classes. That brings us to the chart of the Dollar Index:

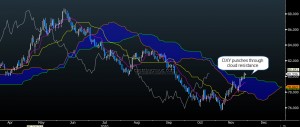

Dollar Index - Ichimoku charts

Not only has the Dollar Index reclaimed the key level of 80, it has also punched through the cloud resistance on its daily charts. If my reading of the wave count here is correct, what we saw between QE2 day and Nov26th was just a milder part of the Dollar Index rally. The stronger portion of the rally has just about begun! ! (Remember the tight inverse correlation between emerging markets/commodities here and here?)

In 2010, emerging markets have had 2 significant corrections prior to November. One in Jan-Feb and the other one in Apr-May. The gross short interest in MSCI EM was 15% lower at November peak when compared with the January peak. That is a substantial level of complacency!!

MSCI EM Gross short interest

Let us also look at Gold which can give us a fair idea of inflationary/deflationary pressures in the global economy.

Gold Daily Charts - A potential H&S top?

The daily charts of Gold shows us that the swing to 1425 is in disagreement with the momentum readings. We can also see the potential for a Head and Shoulder top formation. A close below the neckline, currently at 1340, is likely to augment further selling and a minimum drop to 1225 level is the expected outcome of such a breach.