We have bullish engulfing candle on USD/INR weekly chart. If you want go long on USD place a stop below 48.5 and hold. IF USD/INR hits 52.2 it would prove beyond doubt that the decline from 54.5 was corrective and a new high way beyond 54.5 is coming. I'll be looking at the intraday price movements very closely in the coming days.

From a contrarian point - there are quite a few signals that are coming through for the US markets.

1) Larry Fink of Blackrock says Invesstors should be 100% in equities!!

2) Roubini's firm has turned bullish

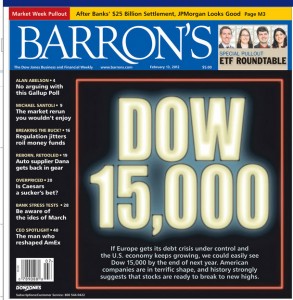

3) Barron's magazine has Dow 15k on its cover and says even 17k is a possibility!!

So either a decline of significance is about to start for US markets (i would prefer Dow 13k or S&P above 1370 and then a fall) or the decline may have already commenced on Friday.

12 Responses to “Couple of snapshot’s”

Sorry, the comment form is closed at this time.

hi jai,

the first two i had guessed, but thought that i am too novice to mentioned that,

regards

Jai,

Can U pls let know you outlook for SBI and Larsen pls.

Regards

Hi Rut,

LT should correct to a bare minimum of 1220 and SBI the minimum is 1980. We have to evaluate based on further inputs. Anything more than 1890 on SBI will tip the odds higher for bears. LT correction beyond 1130 may mean new low. Let us wait and see.

Dear Jai,

What levels for Nifty

Yesterday was an Inside day on Nifty spot.

Regards

Rahul T

Nifty has made 2 inside day not just yesterday. The range is shrinking but no break out has occured. The breach of 5325 would mark the start of correction.

Best regards,

Jai

Sorry Jai confused. Are we expecting a breakout? Thx.

Hi Vivek,

This has been one tough cookie 🙂 isnt it? It is testing our patience to the limit. Even to go long one has to wait. Momentum is disagreeing in a big way in many index stocks like Larsen. Even if the markets head abv 5440, the move will be laboured one. The higher this market goes, the more vertical and heavier the drop going to be.

Thanks Jai. I agree, patience is the key and goig long right now looks like suicide. Thanks again. Will wait for this to resolve one way or the other.

btw, the option setup tells me we may not drop below 5300 before Feb expiry. But anything can happen after that 😉

Jai, do you advise to hold Bharti Airtel. your view please, thanks

Dear Jai,

How much is the probability of Nifty correcting from this level before going further up and if it corrects from here what the bare minimum level it should touch on the downside as per your opinion.

Dear Anita,

Unless Nifty heads below 5325, the correction would not set in. The bare minimum for correction though is 5077 – I should say something like a guarantee.